21 December 2023

On the same day that the Scottish government made full use of its devolved powers to introduce a new tax bracket, the Welsh government also made its draft budget announcement.

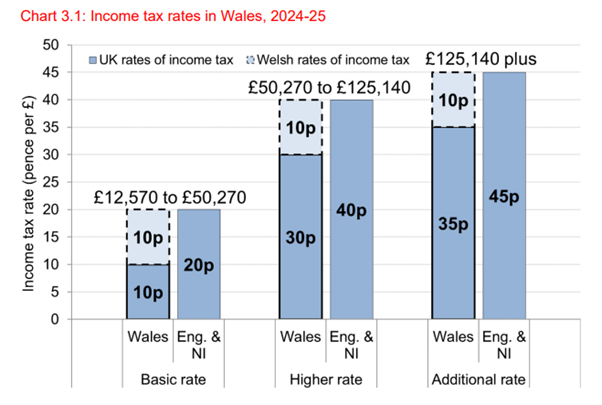

The Welsh government has the power to amend the Welsh rates of income tax (WRIT) by certain amounts. The UK rates are reduced by 10p for each bracket and the Welsh government has the power to set the remainder, they are currently all set to 10p, remaining at parity with England and Northern Ireland.

For the 2024/25 tax year, the rates will continue to be set at 10p, retaining parity.

To illustrate how the WRIT works, the below graph has been taken for the budget narrative document:

Information provided in this news article may be subject to change. Please make note of the date of publication to ensure that you are viewing up to date information.