17 May 2023

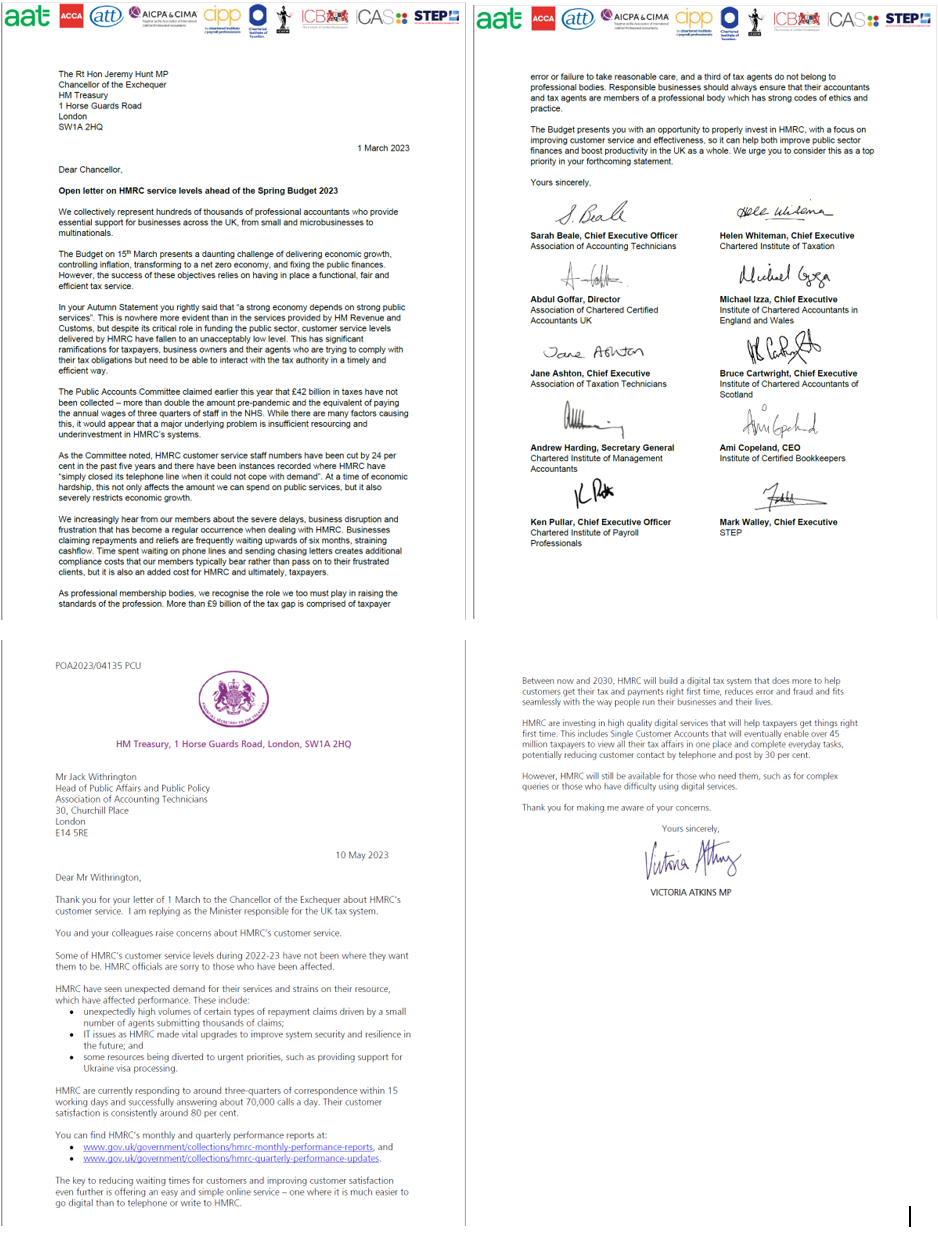

The CIPP and nine other organisations have come together and written an open public letter to Chancellor, Jeremy Hunt. The letter addresses the serious issue around HM Revenue and Customs (HMRC) service levels and funding. Last week, a response was received by the Financial Secretary to the Treasury, Victoria Atkins MP.

Collectively representing payroll professionals, accountants, tax experts, agents, individuals and businesses, the letter was backed by AAT, ICAEW, ACCA, CIMA, CIOT, ICAS, ATT, ICB, STEP, as well as CIPP. Amid discussions between the bodies and feedback from several members, the letter clearly states the government needs to make efforts to find extra funding, in order for HMRC to deliver its critical role in funding the public sector. A strong illustration on HMRC service levels falling and the impacts this has on taxpayers, agents and businesses from performing their duties, was conveyed.

The letter stated:

‘‘We increasingly hear from our members about the severe delays, business disruption and frustration that has become a regular occurrence when dealing with HMRC. Businesses claiming repayments and reliefs are frequently waiting upwards of six months, straining cashflow. Time spent waiting on phone lines and sending chasing letters creates additional compliance costs that our members typically bear rather than pass on to their frustrated clients, but it is also an added cost for HMRC and ultimately, taxpayers.’’

The letter also concluded:

‘‘The Budget presents you with an opportunity to properly invest in HMRC, with a focus on

improving customer service and effectiveness, so it can help both improve public sector

finances and boost productivity in the UK as a whole. We urge you to consider this as a top

priority in your forthcoming statement.’’

In response, Victoria Atkins, Conservative MP for Louth and Horncastle answered:

‘‘Some of HMRC’s customer service levels during 2022-23 have not been where they want them to be. HMRC officials are sorry to those who have been affected.

HMRC have seen unexpected demand for their services and strains on their resource, which have affected performance.

HMRC are currently responding to around three-quarters of correspondence within 15 working days and successfully answering about 70,000 calls a day. Their customer satisfaction is consistently around 80 per cent.

The key to reducing waiting times for customers and improving customer satisfaction even further is offering an easy and simple online service – one where it is much easier to go digital than to telephone or write to HMRC.

Between now and 2030, HMRC will build a digital tax system that does more to help customers get their tax and payments right first time, reduces error and fraud and fits seamlessly with the way people run their businesses and their lives.

HMRC are investing in high quality digital services that will help taxpayers get things right first time. This includes Single Customer Accounts that will eventually enable over 45 million taxpayers to view all their tax affairs in one place and complete everyday tasks, potentially reducing customer contact by telephone and post by 30 per cent.

However, HMRC will still be available for those who need them, such as for complex queries or those who have difficulty using digital services.

Thank you for making me aware of your concerns.’’

It is evident from consultations released and the response received, that HMRC is on a digital journey and this remains to be the solution proposed. However, we hope that our communal voice through this letter, also raises the importance of fixing a broken system before rolling out an all-inclusive digital deal.

Professionals and businesses can also view HMRC’s monthly and quarterly performance reports.

Information provided in this news article may be subject to change. Please make note of the date of publication to ensure that you are viewing up to date information.