12 May 2023

Paper submission of P11Ds and P11D(b)s will no longer be accepted by HM Revenue and Customs (HMRC). This includes all benefits and expenses due to be reported for the 2022/23 tax year.

Benefits and expenses will need to be submitted online through HMRC’s PAYE online service or via commercial payroll software. The PAYE online service can be used if you have up to 500 P11D and P11D(b) returns to complete.

Paper forms sent to HMRC on or after 6 April 2023 will be rejected as they will not be in the prescribed format. HMRC will advise the correct method to provide them, however this will inevitably lead to delays.

In addition, paper amendments will no longer be accepted. HMRC has developed the G-form amendments solution to replace the print/post versions used in previous years, when reporting changes on P11D and P11D(b) returns. There is no specific timeline to prepare for and submit an amendment. HMRC has recognised that circumstances may arise where a small volume of amendments will need to be made, therefore the URL links to the amendment G-forms are now available on the P11D/P11D(b) GOV.UK pages.

Payrolling benefits

Employers can remove the requirement to send P11Ds to HMRC and their employees, by opting to payroll benefits. By payrolling benefits, you increase employees taxable pay by the benefit value, so they pay the relevant PAYE via the payroll in real time.

New informal payrolling arrangements will no longer be accepted from 6 April 2023. Informal agreements already in place will still be accepted, but a formal agreement should be arranged as soon as possible. More information regarding payrolling benefits can be found on GOV.UK.

If you, or a client, is still relying on the paper P11D process, make steps to ensure compliance with the change of process as soon as possible.

Paper P11Ds provided to employees will still be allowable, this only relates to the HMRC submissions. However, it is important to check the guidance on benefits that can and can’t be payrolled.

Electronic P11Ds will still need to be submitted for any employees where additional benefits have not been payrolled.

All benefits can be payrolled apart from:

- living accommodation provided by you as an employer

- interest free and low interest (beneficial) loans.

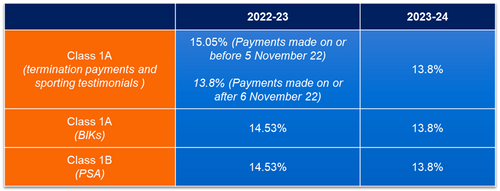

P11D ‘blended’ NIC rates

There were numerous changes to national insurance (NI) last tax year. With all those changes, it is worth taking stock of what we should be doing to stay compliant. So here’s another reminder, but on national insurance contributions (NIC) blended rates for benefits in kind (BIK) for 2022/23.

For benefits in kind subject to Class 1A NICs, and benefits covered by a PAYE Settlement Agreements (PSAs), subject to Class 1B NICs, a blended rate of 14.53% will apply.

Termination payments and sporting testimonials made before 5 November 2022 will be applied at 15.05% and 13.8% after 6 November 2022.

For BIKs provided from 6 April 2023, the rates match the standard percentages of the employers Class 1 secondary contribution of 13.8%.

For more in-depth guidance head over to GOV.UK where HM Revenue and Customs (HMRC) publishes the CA44 guidance.

The CIPP offer the choice of five courses around the complex area of benefits and expenses. To find out more on any of these courses, please click here.

Information provided in this news article may be subject to change. Please make note of the date of publication to ensure that you are viewing up to date information.