09 August 2023

HM Revenue and Customs (HMRC) has released information about reporting secondary (employer) National Insurance contributions (NICs) in relation to Investment Zone Employer NICs Relief (IZENR).

Announced in the Growth Plan of 2022 last year, and further details announced in the Spring Budget earlier this year, it was confirmed that 12 new investment zones will be launched across the UK, which will include eight in England and four across Scotland, Wales and Northern Ireland. There will be certain employer National Insurance (NI) savings and tax reliefs, similar to those for Freeports. The package of tax reliefs available in Investment Zones has been carefully designed to bring forward new investment by reducing the cost of doing business. Freeports and Investment Zones are collectively called ‘special tax sites’.

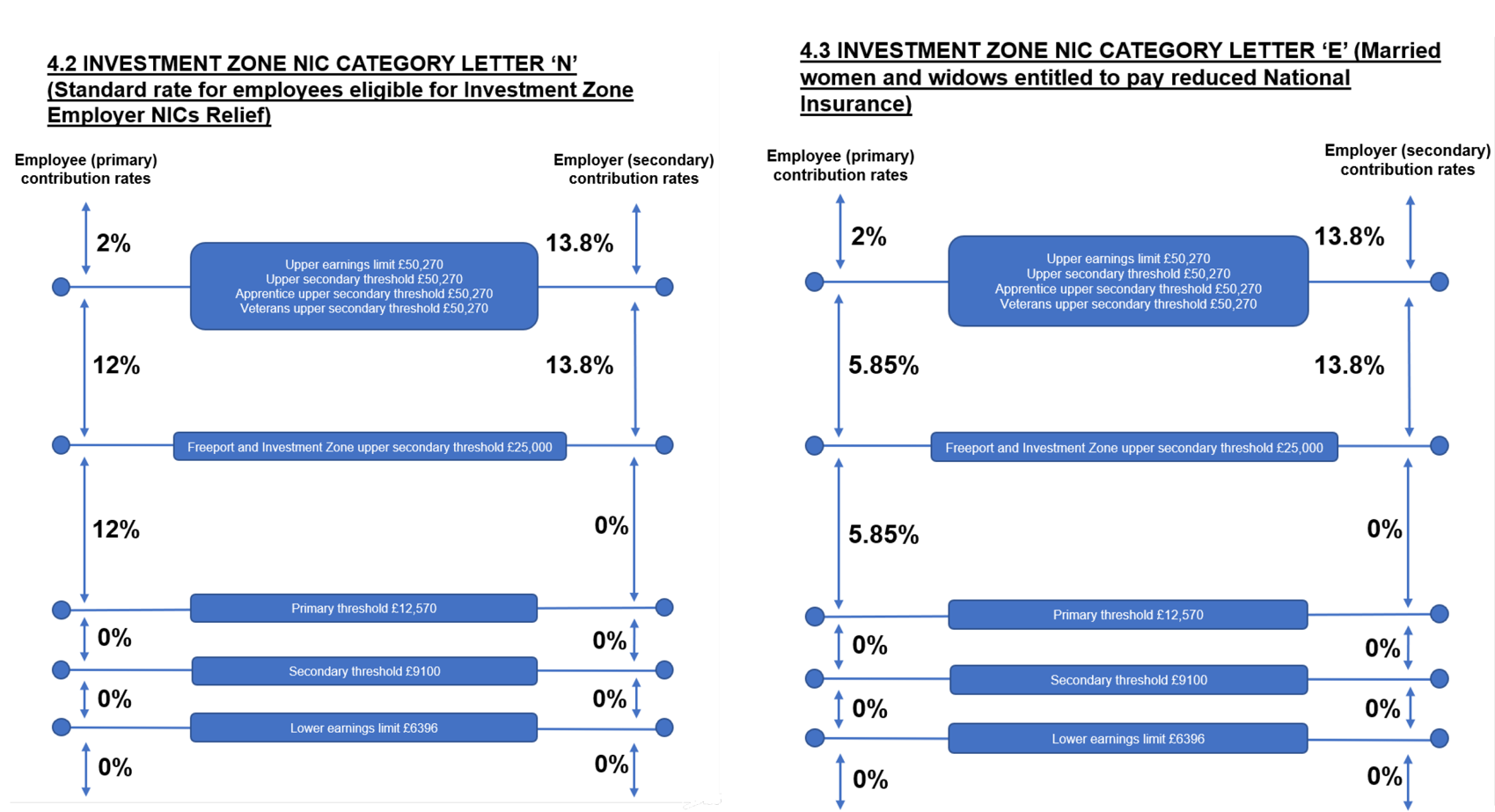

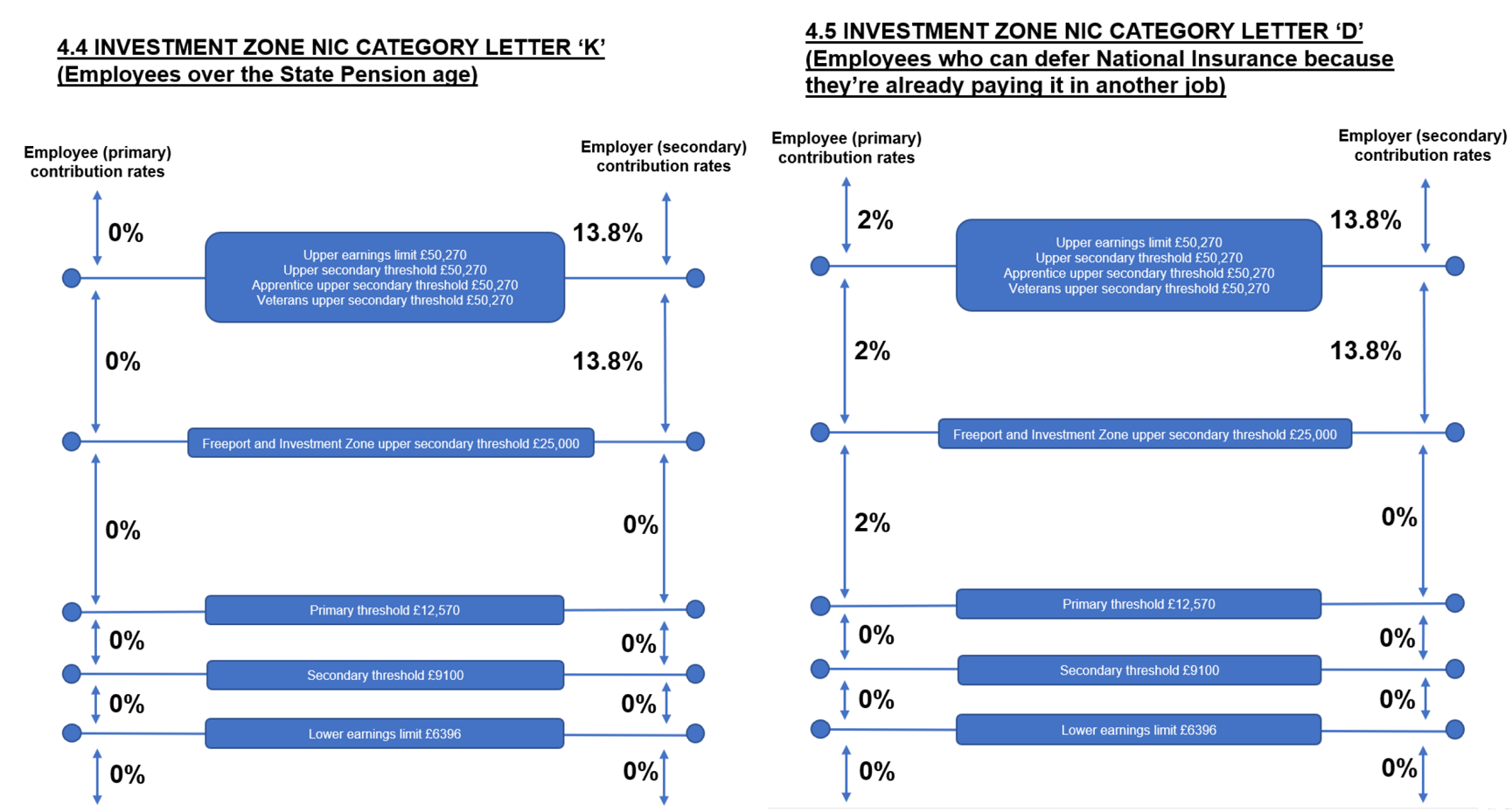

A reduction in the rate of employer NIC’s will be available for all Investment Zone tax site-based businesses i.e. employers located within a prescribed geographic area and only for employees who are working in that area (where the conditions to claim the relief are met). Application of a zero-secondary rate of employer NICs for such employees’ earnings above the secondary threshold (£9,100 per annum) up to and including an upper secondary threshold (£25,000 per annum) equivalent to the Freeport upper secondary threshold, where the conditions to claim the relief are met. The balance of earnings above this upper secondary threshold will be charged at 13.8%. However, the calculation of primary Class 1 NICs is unaffected and the relief will be available from the date the first Investment Zone tax site is operational.

Eligibility

Employers based in Great Britain:

- they must have business premises in the Investment Zone tax site

- the employee must be a new hire whose employment starts on or after 6 April 2022 and before the applicable sunset date, and the employee cannot have worked for that employer (or an employer connected to the employer) in the previous 24 months. At the start of the qualifying period, the employer

must reasonably expect that the employee will spend a minimum 60% of their working time in the Investment Zone tax site

- eligibility to claim will expire 36 months from the employee’s start date of their employment

- there is no limit on the number of employees an employer can claim for

- employers will self-assess eligibility for the relief using available guidance from HMRC

- in respect of off-payroll workers, the relief can be claimed by the liable secondary contributor for the eligible employee.

Details supporting Investment Zone employers based in Northern Ireland will be released as soon as they’re available.

Delivery and new NIC category letters

Four new Investment Zone NIC category letters will be available from 6 April 2024, in order to implement the NIC relief:

- N - (standard category letter)

- E - (married women and widows entitled to pay reduced NICs)

- K - (employees over the state pension age)

- D - (employees who can defer paying 12% NICs and pay only 2% because they are already paying it in another job).

These new category letters mirror existing NIC category letters A, B, C and J, respectively. If an employer has an employee for which they would use a different NIC category letter (e.g. mariner), they will be able to contact HMRC at the end of the tax year and a manual process will be in place to enable overpaid employer NICs to be claimed back. The reporting of primary Class 1 NICs on the full payment submission (FPS) and P60 remains unaffected.

Where several different NIC Category letters could be applied, the employer has discretion to choose the NIC category letter which provides most benefit. For example, if an Investment Zone employer hired a new worker, who was also a Veteran, various category letters may apply. It would be for the employer to select which category letter is most beneficial to them. Confirmation of rounding rules, and example scenarios for each of the category letters above will be included within the National Insurance Guide (EB5).

In the event an Investment Zone tax site becomes operational before 6 April 2024, employers will be able to claim the relief using the existing Freeport NIC Category letters instead. This is a temporary arrangement until the Investment Zone NIC Category letters become available. All Investment Zone Employer NICs Relief claims made from 6 April 2024 onwards (including if the employer has made a claim in relation to the employee prior to 6 April 2024) must be made using the NIC Category letters N, E, K or D.

HMRC will shortly publish the 2024/25 RTI RIM artefacts and associated technical documents in the RTI technical pack, here.

Information provided in this news article may be subject to change. Please make note of the date of publication to ensure that you are viewing up to date information.